Are you looking for business funding? You have probably already spoken to your bank but there isn’t interest, or they can’t help due to your present circumstances, or maybe their terms are just too challenging?

Where do you go to find alternative solutions? It’s such a maze, and you don’t have the contacts or relationships.

That’s why HuntFunding exists; we provide UK business owners and managers with the necessary support and links to potential investors and funding sources to secure a successful raise.

We have been successfully helping business reach their fundraising goals for over 20 years. We primarily assist post-revenue businesses seeking to raise from £500K to multi-millions of pounds. We are though happy to consider pre-revenue businesses that can demonstrate significant growth potential.

What type of business funding is available?

We are unusual as we can provide access to an extensive range of alternative money solutions. Options we have available for our UK clients include:

- Equity Investment (You sell a share in your business)

- Debt Finance (You borrow money)

- Asset Finance (Loan finance for the purchase of machinery or property)

- Future Funding (Securing finance based on forward orders or contracts and invoicing)

- Trade Finance (Making it possible and easier for importers and exporters to transact business and grow business)

- Commercial Mortgages (For commercial premises)

- Bridging Loans (If you need a short-term business loan to ‘bridge’ a particular financial shortfall)

- M&A (MBO and IBO funding for the purchase of established businesses)

- Grant Funding

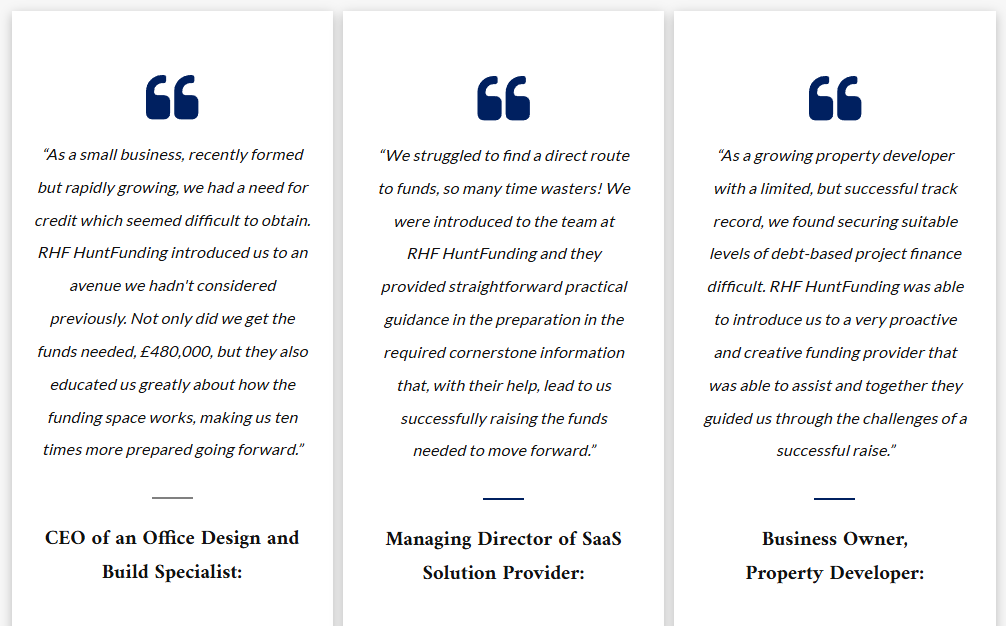

Have a look at what our clients have to say

Interested? Contact Ian on ihunter@rhfhub.com or tel:07746232797

Alternatively, Contact Juan at BBX on juan.harris@bbxworld.com or 01395 642 387